When do buyers start to rely on sellers?

I saw two apparently conflicting statistics this week.

The first from G2’s 2023 Buyer Behavior Report says that only 1% of buyers rank a technology salesperson as the most influential source of information.

“A software company salesperson is the least influential source [of information] in purchasing

processes at 1%, decreasing from 3% year over year (YoY).”

Buyers suggested that 85% of the most influential information sources include:

industry experts

colleagues

professional networks

online reviews

other internal influencers.

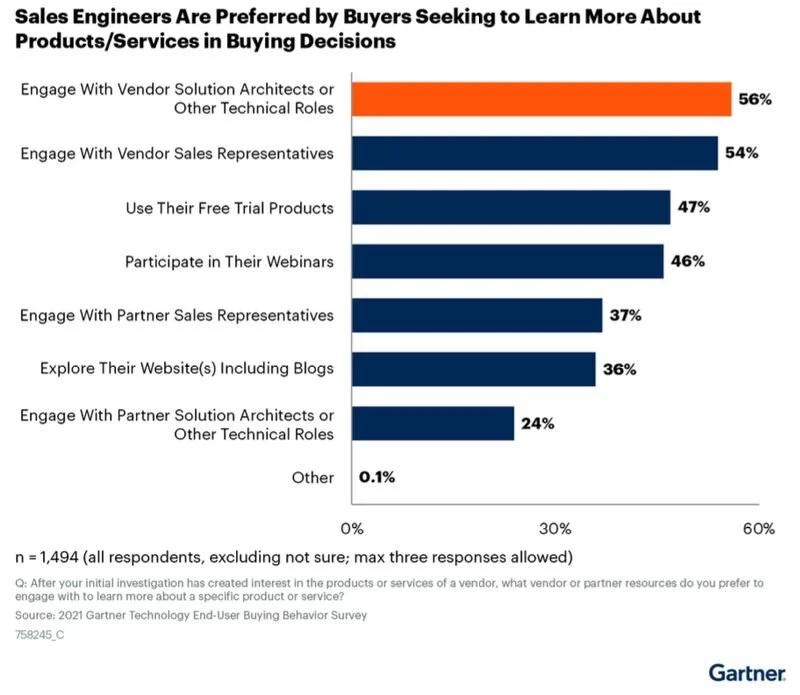

And yet in this Gartner chart from their 2021 Buyer Behavior Survey respondents rated vendor sales engineers and vendor account executives as the preferred source of information.

How can this be?

Buyers rely on different sources at different stages of their buying process

The buying process is complex.

Gartner suggest that buyers have six discrete jobs they need to complete to be able to buy anything.

The nuance between the two statistics is that they are looking at different parts of the buyer journey.

Buyers identify problems with their peers

Whilst G2 doesn’t publish the specific question that drives the 1% statistic, the report focuses on how buyers become aware of the problems they are facing and potential solutions to those problems.

They are in the problem identification, solution exploration and later the requirements building phases.

With so much work to do, and so many potential vendors to work with - this is the time when buyers rely on their colleagues, peers, professional networks and analysts to guide them and shortlist potential programs.

“What is everyone else doing?”

If we think about buying a car - this is the phase when you speak to your friends, you watch car TV programmes, read auto magazines, read newspaper reviews - and build out your short list.

You don’t want to speak to a salesperson at a dealer yet as you know you’ll just get pitched.

Buyers configure solutions with vendors

Having defined the problem and shortlisted a handful of possible solutions, now the buyer starts to rely on individual vendor resources.

Take a look at the specific question in the Gartner survey:

“After your initial investigation has created interest in the products or services of a vendor, what vendor or partner resources do you prefer to engage with to learn more about a specific product or service?”

The question is very specific - you have already shortlisted a specific vendor, you now want to learn about that specific product or service, and the question even provides a constraint that you can only learn from vendor or partner resources.

The buyer is now in the supplier selection or validation phase of their process and they need a technical and experienced resource to help them map out:

integration architecture

project timelines

roles and responsibilities

budgets and licence requirements

roadmaps and future functionality

These are topics that can only be supported by experienced vendor or partner resources.

Buyers rank the solution architect, sales engineer or other technical role over the Account Executive or sales rep, as it is the technical answers they are seeking.

Consider again a car purchase. Once you have narrowed down to a particular brand and model, when you do arrive at the dealership you likely have some very specific questions about available options, the financing, or the delivery lead times.

These questions are likely not suitable for the junior rep who is on the front door, but likely an experienced parts or finance colleague at the back of the showroom.

Match your sales resources to the relevant stage of the buyer journey

Both statistics are correct.

At the start of the buying journey the buyer doesn’t trust or seek out vendor content or people - they aren’t at that stage of their process yet.

Once they have educated themselves on the problem and possible solutions, they will rely heavily on your experienced sales engineers and solution architects.

For buyers in the problem identification, solution exploration and requirements building phases:

Co-create content with your existing customers and partners talking about the problems facing companies in your target market.

Encourage your customers to talk about how they assessed these problems and prioritised where to spend their time.

Work with your partners and analysts to create diagnostics, benchmarks and calculators that they can put in front of target accounts.

Figure out how to get anyone (that isn’t someone from your company) to talk about the problems and possible solutions in the private communities and networks your potential customers are part of.

For buyers in the supplier selection and validation phase:

Ensure you have enough technical experience across your Solution Architect/Sales Engineer team - these team members will be influential in bringing deals in on schedule.

Assess which are the most common questions and challenges that buyers come to your technical teams with and create content (written, video, live and on demand events) to answer these topics in advance.

Consider other specialist roles - legal, finance, security that don’t directly link to the product itself.

So you can see how two potentially conflicting statistics actually complement each other.

Keep them both in mind as you build out your Go To Market playbooks.

Get started

Whenever you are ready, there are three ways that I can help you accelerate your revenue.

Buyer Experience Audit - I’ll impersonate a buyer researching your segment and company and let you know what I find. Ideal for planning your Revenue Operations strategy.

Business Model Design Workshops - I’ll work with you and your team to design or refine a business model for a new or existing product.

RevOps Impact Playbooks - I’ll help you implement one or more tactical processes across your revenue teams - content, referrals, testimonials, adoption and more.